Frequently Asked Questions

Cemetery

-

Santaquin City does not purchase back burial rights.

Posting them in the local paper or online are both good options.

-

For a fee, replacement deeds can be requested at the City Office. New deeds will be mailed about within two (2) to four (4) weeks after request.

-

For a fee, you can request a transfer at the City Office. New deeds will be mailed out within two (2) to four (4) weeks.

Use this Burial Rights Transfer Form to start the process.

Curbside Recycling

-

No. Garbage services are mandatory for the preservation of the health and safety of our community.

-

You do not need to separate acceptable recyclables. Everything can go into the recycling cart together.

-

If you would like to opt-out of curbside recycling, contact the city offices at (801)754-3211.

-

Recyclables will be picked up every other week. Click here to view the current pick-up calendar with additional information.

-

No, it is not. Current Santaquin homeowners have the option to Opt-Out of curbside recycling. To Opt-Out, contact the city offices at (801)754-3211. New homeowners will have the option to participate at the time of utility set-up

-

Plastic bottles, aluminum cans, newspapers, and plain cardboard are among the items that can be recycled. Glass, Styrofoam, and food-contaminated items cannot. For a complete list of which materials are acceptable and how to prepare them for recycling, please click here.

-

Our neighbors saved the following:

- Spanish Fork:

- 7450 recycling homes

- 1400 tons or 2,800,000 pounds of recyclables in 2019

- Approximately $56,000 in disposal savings to the city

- Elk Ridge:

- 495 recycling homes

- 110 tons or 220,000 pounds of recyclables in 2019

- $4,400 in savings to the city

- Salem

- 1294 recycling homes

- 243 tons or 486,000 pounds of recyclables in 2019

- $9720 in savings to the city

- Payson

- 2205 recycling homes

- 445 tons or 890,000 pounds of recyclables in 2019

- Approximate $17,800 in savings to the city

- Spanish Fork:

-

The non-payment of services would result in the assessment of late fees, penalties, the potential shut-off of utility services as well as associated collection costs.

-

Solid waste can contaminate an entire truckload of recycled materials which can result in the need to dispose of the full load into the landfill at a cost of per/ton plus the transportation costs, etc. Willful contamination is also a prosecutable offense for which restitution would be sought.

-

Republic Services has accomplished the following:

- Currently provide curbside recycling services to over 65,000 homes in 16 different cities and 2 counties

- Cities are saving approximately $350,000 in combined disposal costs per year

- For every ton of paper recycled, 60,000 gallons of water are saved

- We use 70% less energy using recycled products in manufacturing than with raw materials

- Recycling 1 aluminum can saves enough energy to power a TV for up to 3 hours

-

The cost to participate in this program is listed in our current fee schedule.

-

For every ton of paper recycled, 60,000 gallons of water are saved. We use 70% less energy using recycled products in manufacturing than with raw materials. Recycling 1 aluminum can save enough energy to power a TV for up to 3 hours.

-

Recyclables will be picked up on Monday or Tuesday mornings by 7 a.m. depending on which route you live in. National Holidays may alter this schedule. Click here to see the schedule and map.

-

Please refer to the following information:

Costs:

- The cost to the participants is provided in our Fee Schedule.

- The cost to the city is the amount charged to the participant.

- The city is not charging any surcharges or administration fees. This is a direct flow-through cost. The city is not getting a per-can “kick-back”.

- Reduced amount of solid waste deposited into landfills.

- At the end of each year of service, based on the market for recycled goods and the amounts collected, Santaquin City may receive a small repayment or be assessed a fee for the sale/processing of recycled materials.

Financial Benefits:

- Reduced amount of solid waste deposited into landfills.

- At the end of each year of service, based on the market for recycled goods and the amounts collected, Santaquin City may receive a small repayment or be assessed a fee for the sale/processing of recycled materials.

-

The Benefits of a Recycling Program Are:

- Protects the Environment

- Energy Savings

- Reduces Landfill Solid Waste

- Reduces Solid Waste Tipping Fees

Elections & Voting

-

There is currently no filing fee required at the time of the Declaration of Candidacy in the city of Santaquin.

-

-

Must be:

- 18 years old

- A US citizen

- A registered voter

- A resident of Santaquin (or a recently annexed area) for twelve consecutive months prior to the election.

Any mentally incompetent person, or any person convicted of a felony, or any person convicted of treason or a crime against the elective franchise may not hold office in this state until the right to vote or hold elective office is restored as provided by statute.

To view the Notice to Public click here

-

You may check your voter registration online by clicking here.

-

You can find the forms for voter registration at:

- The Utah County Clerk, Election's Office, located at 100 East Center Street, Room 3600, Provo, UT 84606

- Copy the form from either the QwestDex or the Provo-Orem directories.

- At the Santaquin City Recorder’s office.

- Mail Voter Registration Form to Utah County Clerk, Election's Office, located at 100 East Center Street, Room 3600, Provo, UT 84606

- State online voter registration (if you qualify)

Contact the Utah County Elections Office at (801) 851-8000 for more information regarding voter registration.

-

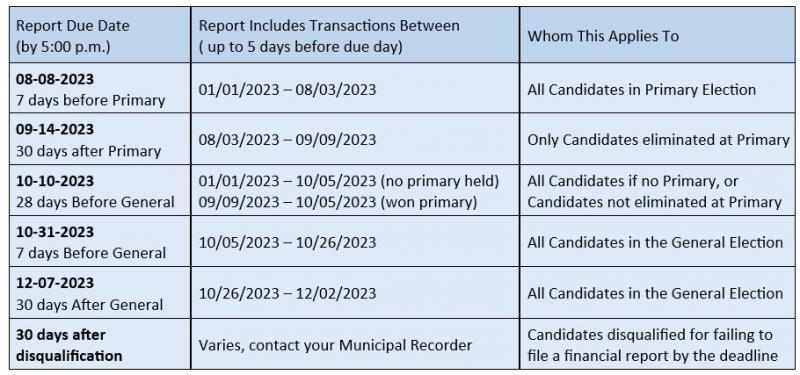

A candidate’s guide will be provided upon filing, and there will be additional training scheduled after the filing period is over.

-

Municipal Elections are held on odd-numbered years. County Elections are held on even-numbered years.

Garbage

-

There is no limit, you can order as many as you need.

-

Garbage day is Monday and Tuesday depending on where you live in the city. To learn more, go to: GARBAGE & RECYCLING PAGE

Cans need to be at the street by 7:00 AM

-

Rates are based on the size of the container. If you have more than what will fit in the can, the garbage company will not collect it. However, you are welcome to order additional garbage cans. Requests require a signature, so you will need to come in or send an email to receive another can. As of 01/01/11, residents can also use the Payson Landfill.

-

Garbage cans can take up to two weeks to be delivered. In the meantime, you are welcome to place up to five (5) black, industrial-strength bags on the curb for pick up. This applies to first garbage cans only. If you have ordered a 2nd, you will need to wait for its arrival.

-

Contact the City by phone at 801-754-3211 as soon as you notice that your can was not dumped. The sooner you report the problem, the more likely it will be able to be resolved. Anything reported later than noon the following day will not be picked up until the next garbage day

-

If New Years', Memorial Day, Labor Day, or Christmas fall on a garbage collection day, your pick up will be on the next business day.

Landfill

-

Santaquin Landfill is classified by the State as a Type IV Landfill and is limited to the collection of yard debris and bio-degradable construction materials. (ie: no household garbage)

-

For a fee, there is a bin at the landfill that may be used for the disposal of household garbage. Or, Santaquin Residents may take debris to the Payson Landfill 801-465-5200.

Parks

-

Reservations are for bowery and restroom facilities only. The playgrounds, ball fields, etc. are public areas.

-

You can begin making reservations on the first working day of the calendar year.

Police

-

If it is an emergency, call 911.

If non-emergency but still urgent, call dispatch at 801-794-3970.

If non-urgent, you may call the police department at 801-751-1070, send an email to police@santaquin.org, or click on the link below. -

You can visit our offices or call:

Santaquin City Police Department

275 W Main

Santaquin, UT 84655Emergency Number: 911

Non-Emergency Number: 801-754-1070

After Hours Non-Emergency Dispatch: 801-794-3970 -

-

-

To request a police record, you will need to fill out a GRAMA request and return it to the police department. You may turn it in by mail or in person at 275 West Main, Santaquin, UT 84655, by fax at 801-754-1697, or by email at police@santaquin.org. You may find the GRAMA request form by clicking on the link below.

-

Did you receive a citation/ticket and aren't sure what to do next?

Take a look at the left side of the citation, and it will tell you which court you need to contact to take care of it. If any of the charges list the status as 'fixit' then you will need to contact the Police Department after fixing the listed issue to get it signed off before taking it to the court. If you have any questions, you may call the Santaquin City Justice Court at 801-754-5376 or the Santaquin Police Department at 801-754-1070.

Pressurized Irrigation

-

The City will take care of the main lines and the line from the main to the meter. Customers are responsible for anything after the meter.

-

It was determined by the residents that the base rate could be more conveniently paid when split over the entire year, rather than only being split over the months that they are also paying usage.

-

There are seven pressure zones. Pressures range from 60 to 100 psi.

Property Tax

-

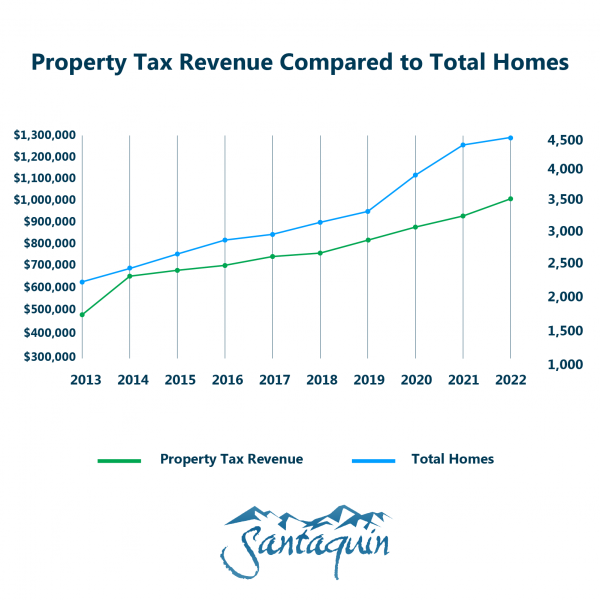

The Santaquin City portion of the property tax rate has not been raised since 2013. During that same time period, the number of homes in Santaquin City has grown by an unprecedented 107% while the property tax rate has decreased by 57%.

Per Utah State Law, the City must decrease the property tax rate when property values increase so that the overall amount of money the City receives stays the same. Unless the City adjusts the property tax rate, the overall revenues it receives will stay the same while costs continue to rise due to inflation.

-

The proposed increase would generate approximately $595,000 in revenue each year.

-

The cost to the average household would be approximately $10 per month.

-

The property tax rate is calculated by the State of Utah using information and data from Utah County and Santaquin City. The City has identified a need for $595,000 in additional annual revenues. If the Santaquin City Council approves the proposed new property tax increase, the new rate would be 0.001404.

-

The City would dedicate approximately $595,000 in revenues generated from this proposed property increase to fund two police vehicles and maintain the recent fair-market compensation increases for firefighters and police officers.

-

The City receives more property tax revenues when more homes are built. However, property tax revenues do not increase at the same rate as growth. This is due to how the property tax rate is calculated. Utah State Law requires that the City’s property tax rate decrease when home values go up so that the amount of money the City receives from existing homes stays the same.

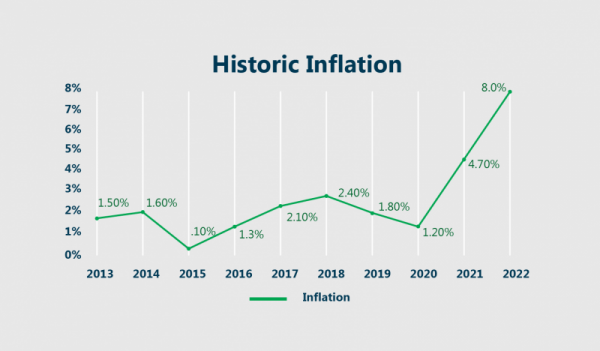

While the number of homes has more than doubled, property tax revenues from those homes have only increased by 66%. In addition, inflation has increased by 24.7% during that same time period, reducing the City’s ability to pay for needed wages, goods, and services. Unless the City adjusts the property tax rate, the revenues it receives from existing homes will stay the same while costs continue to rise due to our population growth and historic inflation.

-

When property valuations increase or decrease, property tax rates change to maintain revenue neutrality. This revenue-neutral rate is called the certified tax rate. The certified tax rate is then applied to all properties, including new residential and commercial developments. The Santaquin City certified tax rate itself has decreased by 57% in the last ten years.

-

Property tax revenues have only increased over the past ten years due to growth. Newly built homes and businesses pay property taxes that have increased the overall amount of revenues the City has received. While these revenues have increased, so has the need for the City to provide vital services to more residents.

-

The City has a demonstrated history of efficiently and effectively using trusted taxpayer resources for the public good. The City has kept its commitment to use the revenues from the last property tax increase in 2013 to maintain critical infrastructure, improving 71.2% of all city-owned roads. Visit this interactive map to see exactly which roads have been maintained with the revenues.

-

The value of your home or business property is determined by the Utah County Assessor, not Santaquin City. Property values change regularly. The market itself drives property values and throughout the year, as homes sell, some areas go up in value, some go down, and others do not change at all. The Utah County Assessor uses market-based information to value each property. Some property values may change dramatically in a single year, while other property values may change little in a given year.

-

If the Council enacts the proposed increase, it will go into effect for the 2023 tax year.

-

Homeowners only pay taxes on 55% of the assessed value of their home. So, if the Utah County Assessor determines that the value of a home is worth $434,000 and that home is the primary residence for someone, the owner would pay taxes on that property as if it were worth $238,700 (55% of the full value). Commercial properties and second homes are assessed taxes on 100% of their value.

-

No. The city portion of property tax is a relatively small amount of your overall bill. Under Utah State law, local government entities may apply and collect a property tax. Local entities such as school districts, counties, cities, and special service districts are all responsible for levying their own taxes. The average property tax bill a Utah taxpayer receives includes payments for all these entities, not just the city or town where they reside.

-

Yes. Utah County offers several property tax relief programs for qualifying residents. For more information, click here.

-

Truth in Taxation is the name for a process established by the Utah State Legislature where city and county governments and school districts are required to hold a public hearing and inform taxpayers of potential increases prior to the city council voting on them.

Utah State Law requires that property tax rates automatically adjust when property values increase or decrease so that the amount of money the city receives is the same from year to year. The laws are designed to keep property owner’s tax burden at a constant level from year to year unless the city council votes to increase the tax through a public process.

-

There are several resources available to you if you have questions about your property tax. You can call us at (801) 754-3211, email us at office@santaquin.org, or stop by our offices at 275 West Main Street. We will also hold a public open house on Thursday, July 27, 2023 from 5 p.m. to 8 p.m. at the City offices.

RAP Tax

-

This is a sales tax of 1/10 of 1% (1 penny in every $10 spent in Santaquin).

-

RAP is short for Recreation, Arts, and Parks.

-

This is a 10-year tax, that was approved by Santaquin voters in 2018.

-

Yes, the amount will increase as businesses develop and local shopping increases in Santaquin.

Sewer

-

Sewer is calculated once per year, based on usage from the October read to the April read, this is called the “winter average”.

-

When the lines are being cleaned toilets can bubble and/or emit a foul order. This process is essential to keep sewer lines flowing and preventing undesirable back-ups. Keeping your toilet lids closed is the most simple way to avoid any possible water overspill and contain. This process does not involve sewage unless it was in your toilet, to begin with.

-

The City will take care of the mainline. Customers are responsible for their connection to the mainline.

-

New customers will be billed City average until their personal average can be established.

-

The city average is re-calculated every year, yet has maintained a constant 8,000 for at least the past 10 years.

Utility Billing

-

Yes, Utility bills are due on the 20th of each month. If the 20th falls on a Saturday, Sunday, or a City observed holiday, payments will be accepted until 4:30 PM the next business day. Please note that payments can be made online 24/7.

-

Base rates are billed regardless of usage or occupancy. Having your garbage can remove is the only way to further reduce bills. Contact the City at (801) 754-3211 and they can assist you with removal.

-

Due to advancements in technology, meter readings are now transmitted electronically. Reading devices simply need to be in the area to collect the readings.

-

Rates change frequently. Visit the Fee Schedule for the most current information.

Water

-

Meters in Santaquin City are read electronically. The reading device just needs to be in the general area of the meter and it will transmit the read to the computer.

-

The City will take care of the main lines and the line from the main to the meter. Customers are responsible for anything after the meter. If you have had a leak, it is still a good idea to check with the City and let them know you have repaired it, since monthly water usage can affect other rates, such as sewer.

-

There are seven pressure zones. Pressures range from 60 to 100 psi.

-

Service lines are generally ¾” or 1". Contact the City Office for address specific information

Water Reclamation Facility Project

-

The City has sought public input on many occasions, including an open house in January of 2008, civic presentations in January of 2008, a neighborhood meeting in the County in April of 2008, and a second open house and public hearing in May 2008. In addition, the City has formed a Community Advisory Committee (CAC) made of 10-20 members of the community. The CAC has met four different times to discuss the alternatives. Santaquin residents attending these meetings and the CAC have stated a strong interest in investing in a long-term solution that provides reclaimed water, does not send water to Utah Lake, allows Santaquin to control their own wastewater decisions, and seeks to keep user rates at acceptable levels. Subsequent public hearings were held in May and December of 2009 and April of 2010.

-

The overall cost of this project is $16.31 million dollars. However, $6.3 million of that cost will be paid in the form of grants, $2.2 million in resources the city has on hand and the remainder in long-term low-interest bonds.

-

Due to a requirement of the USDA, the funding for this project plans for a ‘zero’ percent growth rate. As such, even if growth does not continue, the City of Santaquin will be able to meet this financial obligation. This approach, although extremely conservative in design, creates a financial burden on our existing users. To help offset this financial burden, the USDA increased their grant amount from $2 million to $5 million dollars.

-

No. There is no pending or anticipated litigation with regard to the WRF project.

-

The Santaquin City WRF will be the first in the State of Utah that will provide 100% reuse of its water. By reusing this precious water resource in our pressurized irrigation system, we are ensuring that our community will have the water it needs for decades to come.

-

The facility is being designed to look like a rural barn to fit into the surrounding orchards in the area. The entire operation will be fully enclosed and reside on a 10-acre parcel that has plenty of room for expansion.

-

The project will break ground in January of 2011 and take approximately 18 months to construct.

-

The new system will be located on the north side of Santaquin City along the west side of Center Street in between the railroad tracks and the Strawberry-Highline Canal.

-

This project required approvals from various entities throughout the design and funding process. Approvals were granted by funding and design partners (e.g. UDSA, DWQ, DWR, CUP, EPA, etc.) Ultimately, every phase of this project was approved by our elected and appointed officials through the Santaquin City Council, Planning Commission, and Development Review Committee.

-

In order to qualify for the funding of this project with the assistance of Federal and State agencies, the average Santaquin City Sewer Rate was required to be $42 per month. This necessitated an increase of $20 per month per connection.

-

Our current sewer lagoons are beyond capacity. They were designed in 1994 to provide capacity through 2012 for a population of approximately 4,500. However, growth over the last 16 years has exceeded those 1994 projections. Today our population is over 8,500 and continues to grow.

-

The process is a very clean low odor operation. Santaquin City is taking every precaution to ensure that odors are imperceptible by fully enclosing the process in buildings that have a slight negative pressure. This means that air from the outside will be pulled indoors when doors are opened. In addition, air scrubbers will be installed in the HVAC system. Finally, there will be no storage of bio-solids onsite. All of these steps will ensure the lowest possible odor issue.

-

History has proven that growth will come. As such, the revenue that new growth will bring, in the form of impact fees and monthly user rates, will allow the City Council of the future the ability to either pay down the debt early or lower everyone’s monthly user rate.